The smart Trick of Pvm Accounting That Nobody is Discussing

The smart Trick of Pvm Accounting That Nobody is Discussing

Blog Article

7 Simple Techniques For Pvm Accounting

Table of Contents7 Simple Techniques For Pvm AccountingSee This Report about Pvm AccountingPvm Accounting for DummiesThe 30-Second Trick For Pvm AccountingGetting My Pvm Accounting To WorkNot known Details About Pvm Accounting

Manage and deal with the creation and authorization of all project-related billings to consumers to promote excellent communication and stay clear of issues. construction taxes. Guarantee that ideal reports and documents are submitted to and are upgraded with the internal revenue service. Guarantee that the audit process abides with the law. Apply required construction bookkeeping requirements and treatments to the recording and coverage of building task.Interact with different financing companies (i.e. Title Business, Escrow Firm) pertaining to the pay application procedure and needs needed for repayment. Help with executing and preserving interior financial controls and procedures.

The above statements are intended to define the general nature and degree of job being performed by people designated to this category. They are not to be construed as an extensive checklist of duties, obligations, and abilities required. Employees might be needed to execute obligations beyond their typical obligations periodically, as needed.

Pvm Accounting - The Facts

You will certainly help sustain the Accel team to guarantee delivery of effective on schedule, on spending plan, jobs. Accel is seeking a Building and construction Accounting professional for the Chicago Office. The Building Accountant executes a range of accounting, insurance compliance, and project management. Functions both separately and within particular divisions to maintain monetary records and ensure that all documents are kept present.

Principal obligations include, yet are not restricted to, dealing with all accounting features of the business in a prompt and accurate manner and supplying records and timetables to the business's CPA Firm in the preparation of all monetary statements. Guarantees that all audit treatments and functions are handled properly. In charge of all financial records, payroll, financial and day-to-day procedure of the accounting function.

Works with Job Managers to prepare and post all month-to-month invoices. Creates month-to-month Task Cost to Date reports and working with PMs to resolve with Job Managers' spending plans for each job.

The Buzz on Pvm Accounting

Proficiency in Sage 300 Building and Realty (previously Sage Timberline Office) and Procore building and construction management software application a plus. https://www.pageorama.com/?p=pvmaccount1ng. Should additionally excel in other computer system software application systems for the prep work of reports, spread sheets and other audit analysis that might be required by monitoring. construction bookkeeping. Need to possess strong business skills and capability to focus on

They are the economic custodians who make sure that construction jobs remain on budget plan, abide by tax regulations, and preserve economic transparency. Building accounting professionals are not simply number crunchers; they are tactical partners in the building procedure. Their key role is to handle the financial elements of building and construction tasks, guaranteeing that resources are designated effectively and economic threats are minimized.

3 Simple Techniques For Pvm Accounting

By preserving a tight grasp on job finances, accounting professionals assist avoid overspending and financial troubles. Budgeting is a foundation of successful building jobs, and construction accounting professionals are important in this respect.

Building and construction accounting professionals are well-versed in these guidelines and make certain that the project abides with all tax needs. To succeed in the role of a building accounting professional, individuals need a strong instructional structure in bookkeeping and money.

Additionally, accreditations such as Cpa (CPA) or Certified Building And Construction Industry Financial Expert (CCIFP) are extremely pertained to in the market. Working as an accounting professional in the building see this and construction industry features an unique set of challenges. Building jobs commonly include tight due dates, altering guidelines, and unforeseen expenditures. Accounting professionals have to adjust quickly to these challenges to maintain the task's monetary wellness undamaged.

See This Report on Pvm Accounting

Specialist accreditations like certified public accountant or CCIFP are also highly recommended to demonstrate competence in building bookkeeping. Ans: Building and construction accounting professionals develop and check spending plans, recognizing cost-saving possibilities and making sure that the job stays within spending plan. They also track expenses and projection monetary needs to prevent overspending. Ans: Yes, construction accounting professionals take care of tax compliance for building and construction jobs.

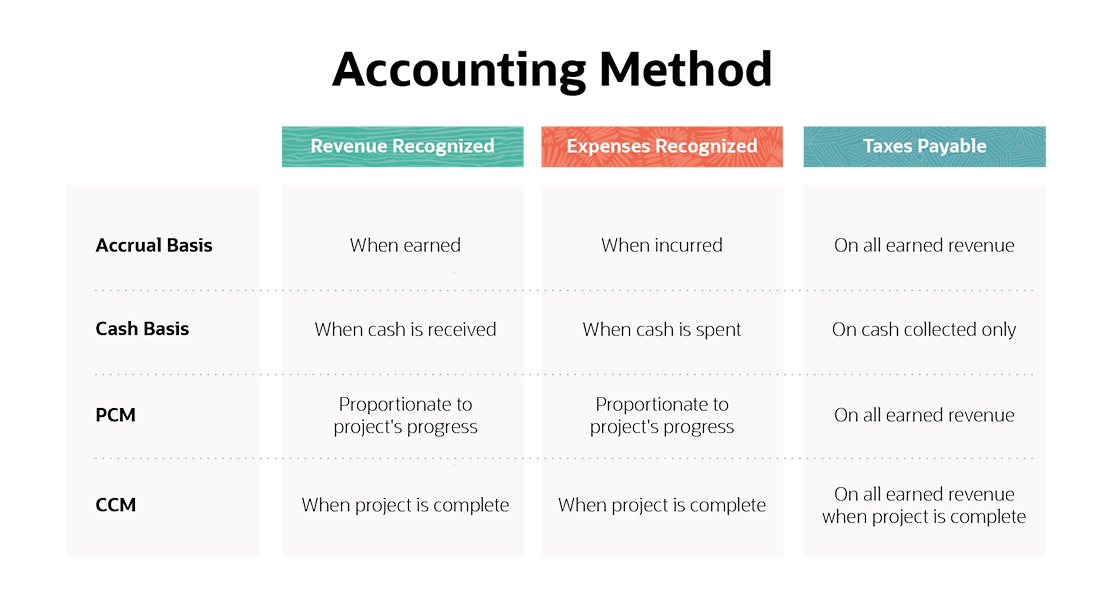

Intro to Construction Accounting By Brittney Abell and Daniel Gray Last Updated Mar 22, 2024 Building and construction business have to make hard options among lots of financial options, like bidding process on one task over another, picking financing for materials or equipment, or establishing a project's revenue margin. Construction is a notoriously unpredictable sector with a high failure price, slow-moving time to payment, and irregular money circulation.

Common manufacturerConstruction business Process-based. Manufacturing involves duplicated processes with quickly identifiable prices. Project-based. Manufacturing requires various processes, products, and equipment with varying expenses. Fixed place. Manufacturing or production takes place in a single (or numerous) controlled areas. Decentralized. Each project takes place in a brand-new location with differing site conditions and unique difficulties.

All About Pvm Accounting

Lasting connections with suppliers relieve settlements and boost effectiveness. Irregular. Constant use different specialty service providers and suppliers affects efficiency and capital. No retainage. Settlement gets here completely or with regular payments for the full contract amount. Retainage. Some part of repayment may be kept up until job conclusion also when the contractor's work is finished.

While typical producers have the benefit of controlled atmospheres and optimized production procedures, building firms should frequently adjust to each new task. Even somewhat repeatable tasks require modifications due to website problems and other variables.

Report this page